Australian consumers aren’t happy.

Sentiment has remained negative this year through May for the first time since the depths of the global financial crisis in 2009. That’s left retailers reeling, hurt car dealerships and made investors bearish on mall operators. As many shoppers are saddled with record household debt and weak wages growth, it’s hard to see the pessimism breaking.

“People are a lot more cautious,” said Tony Farnham, an economist at Patersons Securities Ltd. in Sydney. “There’s not going to be an outbreak of, or surge in retail sales.”

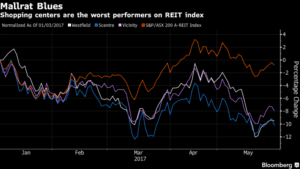

The following charts illustrating recent shifts in stock market performance underscore the challenges facing Australia’s economy, which is struggling to add full-time jobs and boost wages.

CHART 1: The nation’s retail stocks have had the worst start to a year since 2008. Only two of the 10 members of the S&P/ASX 200 Retailing Index are in the black this year — online travel agent Webjet Ltd. and Trade Me Group Ltd., which runs online classifieds and auctions for New Zealanders. With an 18 percent decline, the measure trails the benchmark S&P/ASX 200 Index and the MSCI World Retailing Index, which has been propelled higher by Amazon.com Inc., a looming threatto bricks-and-mortar stores Down Under.

CHART 2: Weak consumer sentiment is being felt in the high street, with the Australian franchisee of Topshop, as well as menswear labels Herringbone and Rhodes & Beckett, appointing administrators. That’s feeding bearish sentiment toward their mall operator landlords. Shopping-center operators Westfield Corp., Scentre Group and Vicinity Centres are the worst-performing stocks on the S&P/ASX 200 A-Reit Index this year.

Lower spending is here to stay even if job growth accelerates, according to David Plank, head of Australian economics at Australia and New Zealand Banking Group Ltd. He expects data released Thursday to show retail sales in April rose just 0.2 percent, after falling for two-straight months. Plank has also cut his projection for first-quarter economic expansion, for an annual growth rate of just 1.5 percent — the lowest since 2009.

Higher employment is taking longer to translate into fatter paychecks the world over and “households now believe the slowdown in wage growth is permanent,” Plank said.

By: Vivek Shankar